The global logistics market continues to play a pivotal role in international trade, driven by increased globalization, e-commerce growth, and technological innovation. The global logistics industry was valued at over €8.4 trillion in 2021 and is projected to exceed €13.7 trillion by 2027. Logistics costs represented about 10.7% of the global GDP in 2020. By 2025, the market is expected to reach US$14.1 trillion, showcasing strong resilience despite challenges such as geopolitical tensions and economic uncertainties.

Dutch Logistics Market Overview

The Netherlands holds a strategic position in Europe’s logistics landscape, serving as a crucial hub for distribution and trade. The Dutch logistics real estate market showed significant recovery in 2024, with investment volumes rebounding to approximately €3.25 billion. Prime net initial yields compressed to about 4.60%, indicating renewed investor interest and strong market fundamentals.

The Dutch logistics sector benefits significantly from its strategic location, connectivity, and excellent multimodal infrastructure, such as the Port of Rotterdam and Schiphol Airport. Demand is predominantly driven by third-party logistics providers (3PLs), reflecting ongoing globalization and e-commerce expansion. Container port traffic in the Netherlands is projected to reach 16.65 million TEU in 2025, underlining the country’s role as a vital gateway for European trade.

Key Logistics Market Trends in the Netherlands

Several trends shape the Dutch logistics market:

- E-commerce Expansion: Rapid growth in online retail, projected to account for 20% of total retail sales in 2025, drives demand for advanced logistics facilities and last-mile delivery solutions. The growth of e-commerce necessitates significant investments in logistics infrastructure, including high-capacity fulfillment centers and efficient distribution networks.

- Technological Adoption: Logistics firms are increasingly investing in automation, AI-driven analytics, and IoT solutions to enhance operational efficiency and responsiveness. These technological advancements enable logistics providers to streamline operations, reduce costs, and improve overall service quality.

- Sustainability Initiatives: Increased focus on sustainable logistics operations, including electric vehicle fleets and green warehousing. Companies are actively pursuing sustainability certifications and implementing innovative environmental strategies to meet regulatory requirements and customer expectations.

- Infrastructure Constraints: Limited land availability, zoning restrictions, and power grid congestion impact logistics real estate development, intensifying demand for existing high-quality assets. These constraints elevate the value of strategically located properties, driving further investment in efficient and flexible warehousing solutions.

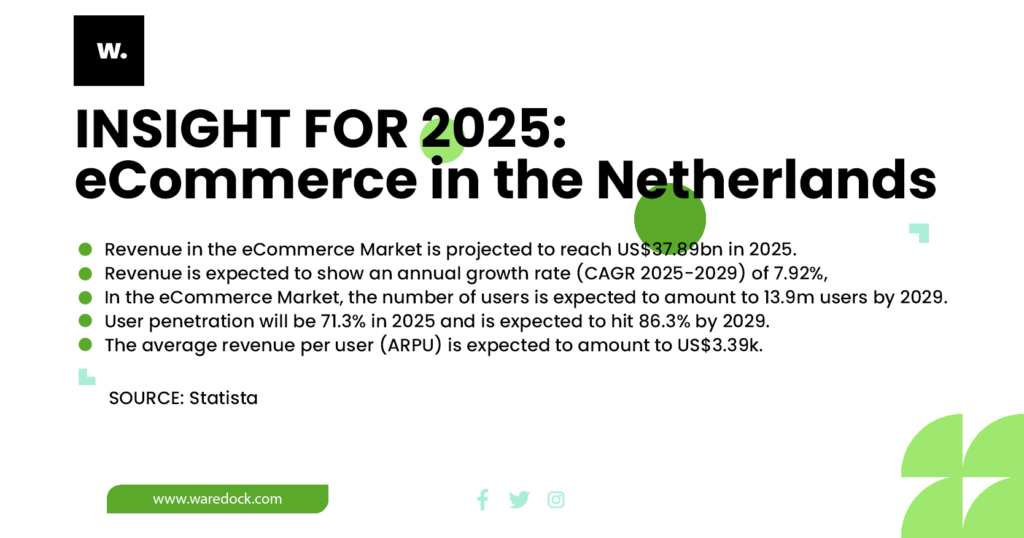

eCommerce Revenue in 2025 in the Netherlands

By 2025, eCommerce revenue in the Netherlands is projected to reach US$37.89 billion, with a user penetration rate of 71.3%. Growth will continue robustly, with revenue reaching approximately US$51.39 billion by 2029, highlighting the increasing significance of digital shopping behaviors among Dutch consumers. The growth trajectory underscores the critical need for advanced logistics solutions to support high-volume online transactions and customer expectations for rapid delivery.

Top 10 Online Stores in the Netherlands (2025 Projections)

- Bol.com

- Coolblue

- Zalando

- Amazon.nl

- Wehkamp

- Albert Heijn Online

- Mediamarkt

- IKEA

- Jumbo

- HEMA

These platforms leverage extensive logistics capabilities, with integrated warehousing, fulfillment, and efficient last-mile deliveries critical to their success. Advanced inventory management, predictive analytics for demand forecasting, and agile supply chains enable these stores to maintain competitive advantages and deliver exceptional customer experiences.

Impact of E-commerce

The explosive growth of e-commerce has radically transformed logistics operations across the Netherlands. Consumers now expect faster, cheaper, and greener deliveries, pressuring logistics providers to adapt at breakneck speed.

1. Warehousing Demand and Location Strategy: E-commerce requires more warehousing space, particularly fulfillment centers that can handle high-volume order processing. This has triggered a surge in demand for well-located distribution hubs near urban areas. Cities like Almere, Breda, and Zwolle are emerging as new hotspots due to lower land costs and proximity to consumers.

2. Last-Mile Delivery Innovation: Last-mile logistics is the most expensive and carbon-intensive leg of delivery. Companies are investing in micro-fulfillment centers, parcel lockers, and bicycle couriers to serve dense urban centers. PostNL, for instance, has rolled out dozens of neighborhood delivery hubs using electric vans and e-cargo bikes.

3. Same-Day and Next-Day Delivery Models: Dutch consumers are increasingly opting for same-day or next-day delivery, especially for groceries and electronics. Bol.com and Coolblue have introduced express delivery services in partnership with local courier startups, pushing the entire sector to accelerate service times.

4. Technology Integration: To manage massive SKU counts and real-time inventory tracking, retailers and logistics providers are deploying warehouse management systems (WMS), predictive analytics, and AI. This allows dynamic routing, smarter workforce allocation, and better delivery time estimations.

5. Urban Logistics Challenges: Congestion, emission regulations, and parking restrictions make urban logistics tricky. Municipalities now work with private players to pilot low-emission zones (LEZs), smart delivery windows, and digital traffic management platforms to ease the burden.

6. Reverse Logistics: E-commerce returns are a logistical headache. Dutch firms are experimenting with automated return lockers, reusable packaging, and AI-driven return fraud detection systems to streamline this process and reduce costs.

7. Cross-border E-commerce Logistics: The Netherlands plays a key role in handling e-commerce shipments entering the EU. Rotterdam and Schiphol process millions of parcels yearly. Customs automation and integration with EU-wide systems like ICS2 help maintain efficiency and compliance.

As e-commerce continues to expand, logistics players in the Netherlands will need to remain nimble, customer-centric, and tech-savvy.

Market Dynamics

The logistics market in the Netherlands has shown strong resilience and adaptability over the past decade. As of 2024, the total market size is estimated at over €90 billion, with healthy year-on-year growth of around 4.2%. This growth is driven by globalization, e-commerce, and increasing demand for specialized services like cold chain logistics and last-mile delivery.

Key Segments:

- Freight Transport: Road transport remains dominant, handling nearly 60% of all goods by volume. Rail freight, though a smaller share, is gaining traction due to EU climate goals. Inland shipping is another stronghold, enabled by the country’s extensive canal and river systems. Air and sea freight handle high-value or long-distance cargo.

- Warehousing & Distribution: The Netherlands offers over 35 million square meters of modern warehousing space. Demand is especially high around “logistics hotspots” such as Venlo, Tilburg-Waalwijk, and the Rotterdam area. Warehouse automation, smart inventory systems, and proximity to transport corridors have become critical decision-making factors.

- Cold Chain Logistics: The growing popularity of perishable goods, pharmaceuticals, and meal kits has driven rapid expansion in cold storage capacity. The Netherlands is a leader in pharma logistics, owing to its centralized location and high compliance with GDP and GMP standards.

- Express and Parcel Services: The surge in e-commerce has propelled B2C and B2B parcel deliveries. Companies like PostNL, DHL, UPS, and new last-mile players are investing in micro-fulfillment centers and sustainable delivery methods.

Investment Flows

The Netherlands has seen an influx of foreign direct investment (FDI) in logistics infrastructure. In 2024 alone, €3.1 billion was invested in industrial and logistics real estate — up 74% from 2023. Investors are particularly keen on light industrial units and urban logistics, reflecting the growing need for proximity to population centers.

Institutional and private equity firms have ramped up their involvement, betting on logistics as a resilient asset class. Government-backed incentives for innovation and sustainability also make the Dutch market attractive.

Technological Innovations

Technology is rewriting the playbook for logistics in the Netherlands. From artificial intelligence to robotics, the sector is embracing automation and digitalization like never before. Let’s explore how these innovations are taking shape:

1. Artificial Intelligence (AI) & Machine Learning: AI is transforming demand forecasting, route optimization, and inventory management. Dutch logistics providers use predictive analytics to anticipate delays and reconfigure supply chain operations in real time. Platforms like Shypple and Quicargo integrate AI into freight matching and pricing.

2. Internet of Things (IoT): IoT sensors are deployed extensively in transport vehicles and warehouses. These enable real-time tracking of goods, monitoring of temperature and humidity (especially for pharma and perishables), and proactive maintenance alerts for equipment.

3. Blockchain: Blockchain adoption is still emerging but promising. Projects like DELIVER and DCSA aim to digitize the entire supply chain using decentralized ledgers. This boosts transparency, minimizes fraud, and accelerates customs clearance.

4. Warehouse Robotics & Automation: From mobile robots to fully automated sorting lines, warehouse robotics are solving labor shortages and increasing efficiency. Dutch logistics hubs are leading adopters of automated guided vehicles (AGVs), robotic arms, and pick-and-place systems.

5. Autonomous Vehicles & Drones: Autonomous delivery vans are in pilot phases in smart logistics parks like Greenport Venlo. Drones are used for internal warehouse transport and are being trialed for last-mile deliveries in rural areas.

6. Digital Freight Platforms: Digital freight matching platforms like Uber Freight (in partnership with Trans.eu), Instafreight, and Portbase are reducing friction in load matching and port operations. These platforms help optimize capacity utilization and reduce empty miles.

7. 5G and Edge Computing: The rollout of 5G is accelerating logistics digitization by enabling low-latency, real-time analytics. Combined with edge computing, it supports advanced use cases such as live fleet telemetry and warehouse coordination.

The Dutch government supports innovation through programs like the Top Sector Logistics initiative, which brings together academia, startups, and corporates to pilot cutting-edge solutions.

Sustainability and Green Logistics

Sustainability is no longer a buzzword in Dutch logistics — it’s a mandate. As the Netherlands moves toward meeting its carbon neutrality goals by 2050, the logistics sector is undergoing a green overhaul.

1. Electric Vehicles (EVs): PostNL, DHL, and other players are rapidly electrifying their last-mile fleets. Urban logistics zones now mandate zero-emission deliveries in cities like Amsterdam and Utrecht. Battery-as-a-service and EV leasing models are making adoption easier for SMEs.

2. Hydrogen and Alternative Fuels: For long-haul routes, hydrogen fuel cells and bio-LNG are being piloted. Shell and Vopak are investing in hydrogen hubs in Rotterdam, while companies like Holthausen Clean Technology build fuel cell trucks.

3. Renewable Energy in Warehouses: Solar rooftops, geothermal heating, and energy-efficient insulation are standard in modern Dutch warehouses. Distribution centers by companies like Bol.com are 100% energy-neutral.

4. Modal Shift Initiatives: To reduce road congestion and emissions, government programs promote modal shifts to rail and inland waterways. Subsidies and tax breaks are offered to businesses using greener modes.

5. Packaging Innovation: Reusable, recyclable, and biodegradable packaging is now a competitive differentiator. Dutch startups like PackBack and Returnless are disrupting packaging with circular economy models.

6. Regulatory Support: The government enforces strict emissions norms and offers incentives through the Climate Agreement. The Green Deal for Sustainable Logistics and the LEVV-LOGIC project promote low-emission vehicle adoption and urban logistics innovation.

Infrastructure & Real Estate Developments

A cornerstone of the Dutch logistics success story is its robust infrastructure and logistics-focused real estate development.

1. Expansion of Logistics Hubs: Established hubs like Moerdijk, Tilburg, and Venlo are expanding capacity, while newer regions such as Emmen and Leeuwarden are emerging as satellite centers. These regions benefit from EU-funded projects improving road and rail access.

2. Smart Warehousing: Next-generation warehouses incorporate automation, AI, and green design principles. Developers like Prologis and DHG are building LEED-certified warehouses with built-in IoT sensors and flexible layouts suited for multi-client usage.

3. Port of Rotterdam Developments: Rotterdam is investing in Maasvlakte II to increase container handling capacity. Digital twin technology and automated cranes are being introduced to optimize port operations and reduce downtime.

4. Rail and Inland Waterway Upgrades: Projects like Rail Freight Corridors and Rhine-Alpine Corridor upgrades enhance rail logistics. Barge traffic on the Rhine and Meuse is supported by digital scheduling platforms and low-emission propulsion retrofits.

5. Urban Logistics Real Estate: The scarcity of urban space has created demand for multi-story logistics facilities, especially in Randstad cities. These urban distribution centers (UDCs) serve the final-mile logistics needs of e-commerce giants and grocery chains.

6. Data-Driven Site Selection: Using GIS and data analytics, logistics real estate investors now evaluate labor availability, access to highways, and permit processes before choosing new sites.

7. Policy and Zoning: Dutch spatial planning integrates logistics needs into long-term regional development. Local governments collaborate with developers to pre-zone areas for logistics, cutting red tape.

The continuous evolution of logistics infrastructure will remain key to maintaining the Netherlands’ global leadership in efficient, scalable, and sustainable supply chains.

Emerging Logistics Companies & Startups in the Netherlands

The Dutch logistics ecosystem is buzzing with entrepreneurial energy. Startups are leveraging digital platforms, automation, and AI to disrupt traditional models and meet evolving market demands.

1. Quicargo: One of the most successful logistics tech startups in the Netherlands, Quicargo connects empty trucks with freight, optimizing routes and reducing emissions. Their platform is now integrated with major carriers and shippers across Europe.

2. Shypple: Billed as a ‘digital freight forwarder’, Shypple offers real-time visibility and booking options for sea and air freight. Their intuitive interface simplifies what has traditionally been a cumbersome process for SMEs.

3. PicNic: While known as an online grocery delivery company, PicNic’s true innovation lies in its fully integrated logistics chain. With electric vehicles, predictive restocking, and regional fulfillment centers, it has redefined last-mile delivery.

4. Bringly: A sustainability-focused last-mile logistics startup, Bringly partners with retailers to deliver same-day shipments using zero-emission transport like cargo bikes and EVs, focusing especially on fashion and lifestyle goods.

5. PackBack & Returnless: These startups are addressing the growing pain point of returns and packaging. Returnless offers automation for reverse logistics while PackBack enables circular packaging systems that reduce waste.

6. FULFIL: A B2B SaaS platform, Fulfil provides smaller e-commerce retailers access to shared warehousing and fulfillment services across the Netherlands, helping level the playing field against giants like Amazon.

The vibrant Dutch startup scene benefits from accelerators like PortXL (focused on maritime/logistics), Yes!Delft, and HighTechXL. Government-backed funds and EU innovation grants also nurture early-stage logistics innovators.

Challenges & Risks for the Dutch Logistics Sector in 2025

Despite its strengths, the logistics sector in the Netherlands faces a number of persistent challenges:

1. Supply Chain Disruptions: Global events, from the COVID-19 pandemic to geopolitical instability (e.g., the Ukraine conflict), continue to expose vulnerabilities in global supply chains. Dutch companies are now building more regional and redundant networks to hedge against shocks.

2. Labor Shortages: There is a growing shortage of drivers, warehouse staff, and tech talent. As the workforce ages, and younger generations seek less physically demanding work, logistics firms are turning to automation and reskilling programs.

3. Urban Constraints: Delivering goods in cities like Amsterdam and Rotterdam is increasingly difficult due to congestion, parking restrictions, and low-emission zones. These challenges force companies to redesign their last-mile models and seek collaboration with municipalities.

4. Real Estate Scarcity: Logistics real estate near urban areas is in short supply. High land prices and zoning restrictions make it harder for operators to expand rapidly to meet e-commerce demand.

5. Regulatory Complexity: The sector is governed by overlapping EU and national regulations. Compliance with emissions standards, data privacy, and customs rules adds operational complexity, especially for SMEs.

6. Cybersecurity Risks: With growing reliance on digital systems, logistics firms are increasingly vulnerable to cyberattacks and ransomware. Cybersecurity resilience is now a strategic priority for many operators.

Addressing these challenges requires a coordinated effort between industry, government, and academia to build a more resilient, inclusive, and future-proof logistics ecosystem.

Future Trends & Predictions for 2025

Looking beyond 2025, several transformative trends are likely to shape the Dutch logistics landscape:

1. Hyperautomation: Logistics will continue to move toward end-to-end automation. We’ll see more AI-powered systems, robotic process automation (RPA), and autonomous vehicles integrated into daily operations.

2. Vertical Integration: Retailers and manufacturers will increasingly own their logistics processes. Examples include Bol.com’s expansion into fulfillment and Coolblue operating its own last-mile fleet.

3. Urban Logistics Ecosystems: Cities will host integrated logistics networks featuring micro-hubs, underground delivery systems, and shared infrastructure for different companies to optimize last-mile operations.

4. Data-Driven Personalization: Advanced data analytics will enable hyper-personalized deliveries, including flexible delivery times, packaging preferences, and rerouting options in real-time.

5. Climate-Tech Integration: Climate concerns will accelerate adoption of low-carbon solutions, from bio-based packaging to electrified inland shipping. Carbon tracking dashboards will become standard for all logistics players.

6. Circular Logistics Models: The rise of the circular economy will drive new logistics needs — from reverse logistics for re-commerce to specialized handling of refurbished and reusable goods.

7. Rise of EU-Wide Smart Corridors: The Netherlands will play a critical role in EU logistics corridors such as North Sea–Baltic and Rhine-Alpine, powered by real-time customs, cargo tracking, and green energy infrastructure.

In summary, the Dutch logistics industry is poised for continued evolution, with innovation, resilience, and sustainability as the guiding pillars.