Table of Contents

1. Amazon

Amazon remains the undisputed leader of e-commerce in Europe in 2025. With a staggering 1.2 billion monthly visitors across its European platforms, Amazon has cemented its dominance in key markets such as Germany, the UK, France, Italy, and Spain. Its Fulfillment by Amazon (FBA) service provides sellers with unmatched logistics capabilities, allowing them to reach customers efficiently and scale quickly.

Amazon’s appeal lies in its vast product selection, superior customer experience, and Prime membership benefits, which include fast delivery, exclusive deals, and streaming content. For sellers, Amazon provides an arsenal of tools—advanced advertising solutions, detailed analytics, and automated pricing systems.

With continued investment in sustainability, regional warehouses, and AI-driven shopping experiences, Amazon remains the most powerful springboard for any business looking to grow across Europe. Fulfillment centers can benefit significantly by offering FBA alternatives or complementing Amazon’s own services.

2. eBay

eBay has stood the test of time as a trusted online marketplace, particularly in the UK and Germany. With approximately 474 million monthly visitors, eBay continues to be a strong player by offering both auction-style and fixed-price listings. Its unique blend of new, used, and refurbished items makes it a go-to platform for value-driven consumers.

For sellers, eBay provides flexibility with low entry barriers, especially appealing to small businesses and individual entrepreneurs. The strong buyer-seller community encourages transparency and trust. Sellers can also benefit from eBay’s promotional tools, shipping integrations, and global reach.

eBay remains relevant due to its niche communities, collector markets, and its evolving platform which now supports certified refurbished programs, better mobile functionality, and seller protections. Fulfillment partners can find opportunities in assisting smaller sellers with inventory management and timely shipping.

3. Allegro

Poland’s e-commerce leader, Allegro, is rapidly becoming a major force in Eastern and Central Europe. With nearly 289 million monthly visitors, Allegro dominates the Polish market and is aggressively expanding into Czechia, Slovakia, and beyond.

Allegro’s appeal stems from its strong local brand, support for Polish-language services, and trusted payment system—Allegro Pay. The platform enables cross-border shipping to 24 countries, offering an attractive channel for sellers aiming to enter Eastern European markets.

Its advanced logistics network, including pickup points and last-mile delivery partners, enhances customer satisfaction. Allegro offers sellers tools for targeted advertising, real-time analytics, and an efficient onboarding process.

For fulfillment centers, Allegro provides a gateway to a fast-growing e-commerce region with high mobile penetration and rising consumer demand. Specialized logistics and regional warehousing are increasingly in demand as more sellers expand through Allegro’s network.

4. Zalando

Zalando is Europe’s leading online fashion marketplace, attracting over 121 million monthly visitors. It has a strong presence in Germany, Italy, the Netherlands, and Poland, appealing to fashion-conscious consumers looking for quality, style, and convenience.

Zalando partners with over 7,000 brands and provides a curated shopping experience that includes clothing, shoes, and accessories. It stands out for its advanced data analytics, personalization algorithms, and sustainability focus. Features like “Zalando Wardrobe” and “Pre-owned” promote circular fashion and cater to eco-aware shoppers.

For sellers, Zalando offers access to its Partner Program, which provides marketing tools, logistics support through Zalando Fulfillment Solutions (ZFS), and real-time sales data. Its high-quality standards and brand alignment make it especially appealing to premium and eco-conscious fashion brands.

Fulfillment providers can capitalize on the need for returns management, high-end garment handling, and sustainable packaging solutions. As fashion continues to shift online, Zalando remains a strategic partner for long-term growth in the sector.

5. Temu

Temu, the fast-growing marketplace owned by PDD Holdings, is gaining momentum across Europe, particularly in the UK and France. With a monthly visitor count exceeding 104 million, Temu is rapidly establishing itself as the go-to platform for bargain hunters looking for a mobile-first shopping experience.

Temu’s low prices, frequent flash sales, and gamified shopping features attract price-sensitive and digital-native consumers. It appeals especially to younger demographics and shoppers seeking novelty and affordability in categories like fashion, home, electronics, and gadgets.

Sellers benefit from early-stage growth with less competition and a scalable platform that is aggressively marketing itself across Europe. While Temu provides basic logistics, third-party fulfillment centers have an opportunity to support sellers with faster deliveries and localized warehousing to reduce shipping delays.

With its rapid expansion and viral marketing campaigns, Temu presents a valuable entry point for sellers aiming to penetrate the European market with affordable products and agile operations.

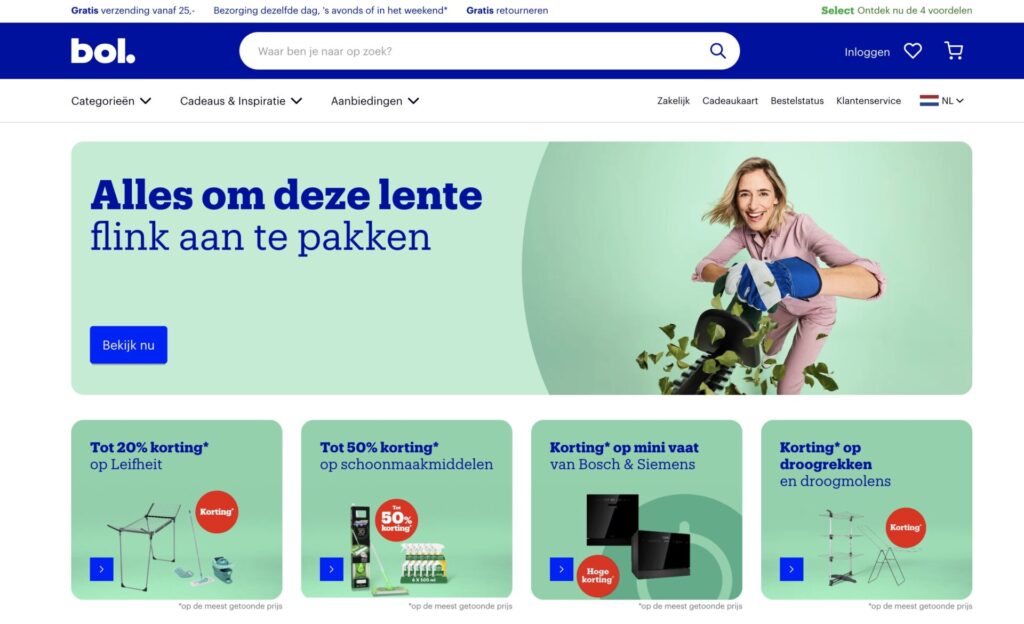

6. bol.com

bol.com is the dominant marketplace in the Benelux region, particularly the Netherlands and Belgium. With over 86 million monthly visitors, bol.com has outperformed Amazon in the region due to its strong local brand, language support, and tailored services for Dutch and Flemish consumers.

The platform offers a wide range of products including books, electronics, fashion, and household items. It is well-known for its seamless delivery and returns process, and bol.com’s integration with local payment systems adds to customer trust and convenience.

For sellers, bol.com provides an easy onboarding process, marketing tools, and regional advertising opportunities. It also supports integrations with logistics providers, offering end-to-end fulfillment and the possibility of using its own warehouse network.

Fulfillment partners can benefit by providing last-mile delivery solutions and helping international sellers expand into the Benelux market. With strong customer loyalty and less saturation than pan-European platforms, bol.com is a valuable marketplace for both domestic and cross-border e-commerce.

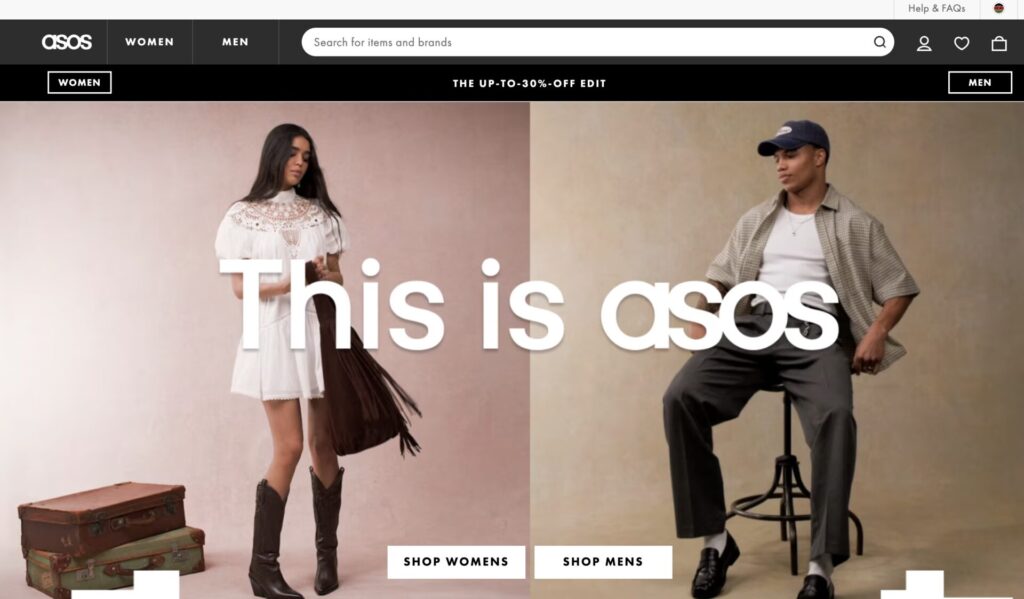

7. ASOS

ASOS is a UK-based fashion marketplace that has carved out a significant presence across Europe. Attracting over 82 million monthly visitors, ASOS specializes in trendy, youth-oriented apparel and has over 900 third-party sellers known as “boutiques.”

Known for its commitment to fashion-forward trends, inclusivity, and a wide size range, ASOS attracts millennials and Gen Z shoppers. The platform offers its own house brands as well as a broad selection of global fashion labels.

Sellers on ASOS benefit from its established reputation, targeted audiences, and powerful fashion merchandising tools. With global shipping infrastructure and easy returns, ASOS supports both direct-to-consumer and third-party models.

Fulfillment opportunities lie in boutique-level logistics, reverse logistics for high return volumes, and packaging tailored to premium and stylish branding. As consumers continue to shift toward fast fashion and curated online experiences, ASOS remains a powerhouse in digital apparel retail.

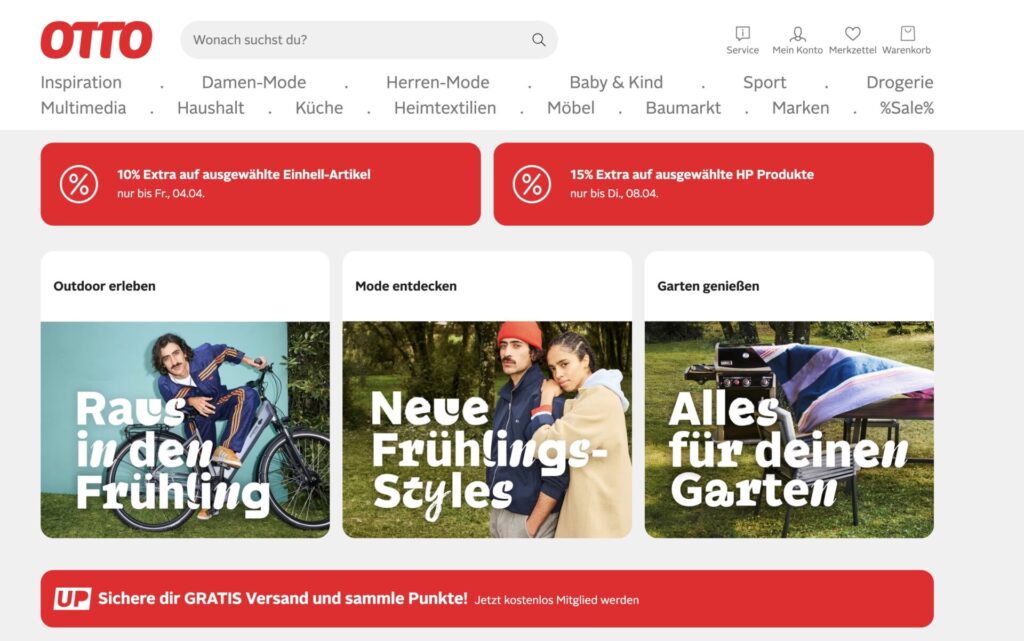

8. Otto

Otto is Germany’s third-largest online marketplace and a well-established name in the country’s digital retail ecosystem. With around 66 million monthly visitors, Otto has carved out a niche by focusing on quality, trust, and customer satisfaction. It offers a wide array of product categories, including electronics, home appliances, fashion, and lifestyle goods.

The platform is known for its premium user experience and partnerships with reputable brands. Otto appeals to a more mature and discerning customer base, often preferring quality over bargain pricing. For sellers, Otto provides robust marketing options, a trusted brand association, and an audience willing to spend more for reliable service.

Otto’s logistics are well integrated, and it supports external fulfillment partners who can help sellers meet German consumers’ high expectations for prompt, secure, and quality delivery. This makes Otto an ideal platform for premium goods, especially in electronics, furniture, and apparel.

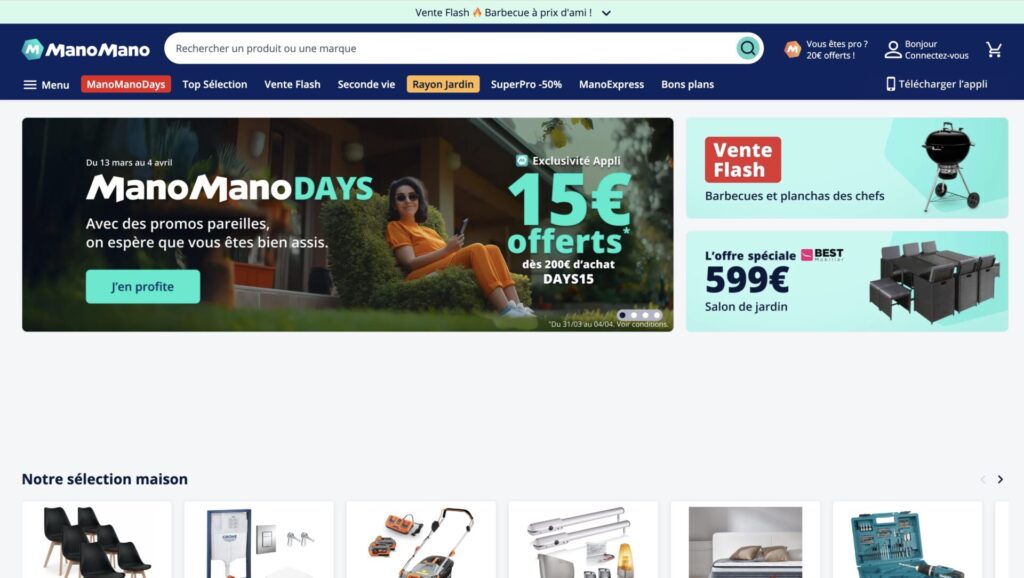

9. ManoMano

ManoMano has emerged as Europe’s leading DIY, home improvement, and gardening marketplace. With 50 million monthly visitors, it operates successfully in France, Germany, Spain, Italy, and the UK, catering to an engaged audience of home improvement enthusiasts.

Specializing in tools, construction materials, garden supplies, and furniture, ManoMano is the go-to platform for both professional contractors and weekend hobbyists. Its niche focus sets it apart from generalist marketplaces, offering specialized product categories and support tailored to the home sector.

For sellers, ManoMano provides a clear value proposition: a highly targeted audience, lower competition, and specialized sales tools. Logistics providers can benefit from managing the shipping of large, bulky, and fragile items while also supporting returns and replacements.

As home improvement remains a popular post-pandemic trend, ManoMano continues to grow, driven by a loyal base and product-specific expertise that generalist platforms can’t easily replicate.

10. Kaufland

Formerly Real.de, Kaufland has rebranded and grown rapidly to become a key player in Germany’s online retail sector. With 32 million monthly visitors, Kaufland.de offers a broad selection of products across multiple categories, including electronics, fashion, home goods, and groceries.

The marketplace benefits from Kaufland’s strong offline retail presence and reputation, allowing for a seamless omnichannel experience. Sellers can list across categories, take advantage of competitive commission rates, and tap into a trusted German brand with strong consumer loyalty.

Kaufland provides access to a powerful merchant center, advertising tools, and integrations with logistics providers. The marketplace also supports pan-European expansion for sellers, offering an entry point into the broader DACH region.

Kaufland operates online marketplaces across several European countries, each with its own localized domain:

- Germany: kaufland.de

- Poland: kaufland.pl

- Czech Republic: kaufland.cz

- Slovakia: kaufland.sk

- Austria: kaufland.at

Kaufland has expanded its online marketplace presence in recent years:

- Slovakia: Launched on February 15, 2023

- Czech Republic: Launched in 2023 under kaufland.cz.

- Poland: Launched in 2024 under kaufland.pl

- Austria: Launched in 2024 under kaufland.at.

These expansions allow sellers to reach new customer bases through Kaufland’s Global Marketplace platform

11. Vinted

Vinted has established itself as one of the leading online platforms for second-hand fashion in Europe. Originating from Lithuania, the platform now serves markets including France, Germany, the UK, and other EU countries, with a monthly visitor base of approximately 28 million. Vinted thrives on its community-driven model that promotes circular fashion, sustainability, and affordable clothing.

Unlike traditional fashion marketplaces, Vinted focuses on peer-to-peer selling, making it easy for individuals to list and sell used clothing. Its intuitive app, low fees, and buyer protection features have made it popular among younger demographics and environmentally conscious shoppers.

Sellers on Vinted benefit from a streamlined process with prepaid shipping labels, minimal listing requirements, and access to a highly active audience. Though the platform currently caters mostly to individuals, professional sellers are beginning to explore Vinted’s potential for bulk second-hand sales.

Fulfillment opportunities are limited due to its peer-based model, but logistics providers may find value in supporting bulk sellers, white-label resale services, or returns processing.

12. Fnac/Darty

Fnac and Darty, two major French retailers, have combined forces to create a powerful e-commerce presence. Their joint online marketplace, which receives approximately 25 million monthly visits, specializes in electronics, books, media, and home appliances. The platform is especially strong in France, Belgium, and Spain.

Fnac/Darty’s reputation for quality service, customer support, and in-store pickup makes it a trusted choice for both consumers and brands. It offers a mix of first-party and third-party listings, giving sellers access to a broad audience while benefiting from the marketplace’s trusted branding.

For sellers, the platform offers professional tools, marketing packages, and integrations with various logistics and inventory platforms. Consumers benefit from extended warranties, customer support, and financing options, which increase cart sizes and conversion rates.

Fulfillment partners can assist sellers with warehousing, last-mile delivery, and appliance installation services—especially in categories like white goods and consumer electronics.

13. Cdiscount

Cdiscount is one of France’s largest online marketplaces, with a stronghold in general merchandise. Attracting around 20 million monthly visitors, Cdiscount offers products in categories such as tech, home, beauty, groceries, and more. Known for competitive pricing and frequent discounts, it appeals to cost-conscious French consumers.

Sellers can benefit from Cdiscount’s wide reach and robust fulfillment network, including its Cdiscount Fulfilment (CDF) service. The platform supports third-party sellers with tools for product listings, marketing, and sales analytics.

Cdiscount’s large logistics infrastructure and connection with the Casino retail group enhance its omnichannel capabilities. It also offers financing and B2B sales options, expanding the market potential for sellers.

For fulfillment centers, there’s an opportunity to collaborate on large-item deliveries, seasonal demand peaks, and local warehousing. With its wide product scope and loyal customer base, Cdiscount remains a vital channel for selling into France.

14. Idealo

Idealo is a hybrid price comparison engine and marketplace based in Germany. With 18 million monthly visitors, it serves both as a shopping assistant and as a direct sales channel for merchants. It is especially popular for electronics, appliances, and tech accessories.

Users come to Idealo to compare prices across hundreds of sellers, making it an important touchpoint in the customer journey. Sellers can list products directly or have their existing e-commerce stores integrated through affiliate links or merchant accounts.

While not a traditional marketplace, Idealo is a strategic channel for increasing visibility, acquiring traffic, and converting price-sensitive shoppers. It’s especially effective for established e-commerce brands and retailers looking to improve reach and ROI on ad spend.

Fulfillment centers can support merchants listed on Idealo with optimized warehousing and fast delivery to capitalize on consumer urgency driven by price comparisons.

15. Rakuten France

Rakuten France, part of the global Rakuten Group, is a well-established online marketplace catering primarily to French consumers. With about 15 million monthly visitors, it offers a wide variety of categories including tech, books, fashion, and home products. Rakuten’s loyalty program and points system set it apart from competitors, encouraging repeat purchases.

Sellers benefit from Rakuten’s high trust factor, flexible fee structure, and promotional tools. The platform also supports affiliate marketing, which can help boost traffic to specific listings. Rakuten’s commitment to merchant support includes personal account managers for professional sellers.

While not as dominant as Amazon or Cdiscount in France, Rakuten France still attracts a sizable, loyal customer base. It’s a particularly good option for sellers targeting consumers who value customer experience, added value, and alternative loyalty rewards.

Fulfillment providers can assist Rakuten sellers with inventory management and timely delivery, especially for large or niche product categories.

16. Notonthehighstreet

Notonthehighstreet is a UK-based online marketplace that focuses on unique, handcrafted, and personalized gifts. With around 12 million monthly visitors, it appeals to customers seeking distinctive products for special occasions such as birthdays, weddings, and holidays.

This marketplace is a haven for artisans, creatives, and small businesses that want to showcase their products to a curated and quality-conscious audience. Categories include home décor, stationery, jewelry, and children’s products—all curated for their originality and charm.

Sellers benefit from a brand-friendly platform that emphasizes storytelling, quality imagery, and boutique presentation. Notonthehighstreet also offers promotional campaigns and features like personalized storefronts.

For fulfillment providers, the opportunities lie in supporting small brands with packaging solutions, order customization, and reliable logistics, especially during peak seasons like Christmas and Valentine’s Day.

17. Spartoo

Spartoo is a France-based fashion and footwear marketplace with a growing European footprint, attracting around 10 million monthly visitors. It specializes in shoes, clothing, bags, and accessories, offering both well-known and boutique brands.

The platform targets fashion-forward consumers in France, Spain, Italy, and beyond, with a strong focus on lifestyle, quality, and value. Spartoo provides a hybrid model that includes direct sales, marketplace offerings, and its own brand collections.

For sellers, Spartoo offers an established logistics framework, multilingual support, and a user-friendly onboarding process. The emphasis on footwear logistics—including sizing accuracy and returns management—makes it ideal for specialized fulfillment centers.

Spartoo continues to grow by adding new product verticals and expanding partnerships, positioning itself as a serious player in the European fashion e-commerce space.

18. PCComponentes

PCComponentes is a leading Spanish e-commerce site for consumer electronics and computer components. With around 9 million monthly visitors, it serves a tech-savvy audience looking for competitive pricing, trusted brands, and reliable delivery.

The platform has built a strong reputation for offering a broad range of products—from graphics cards and laptops to home electronics and accessories—at competitive prices with strong customer service.

Sellers benefit from high conversion rates and a customer base that values detailed product specs, reviews, and speedy shipping. PCComponentes also runs its own logistics operation, though third-party fulfillment services can provide overflow support, regional warehousing, and last-mile delivery.

Given its niche focus, PCComponentes is ideal for electronics brands and retailers seeking to grow in Spain and Portuguese-speaking markets.

19. Farfetch

Farfetch is a luxury fashion marketplace with a global presence and strong traction in key European markets like the UK, Germany, France, and Italy. It attracts about 8.5 million monthly visitors and is known for its curated collection of high-end fashion brands and boutique stores.

The platform serves discerning shoppers looking for exclusive, designer items and personalized shopping experiences. Farfetch partners with luxury brands and independent boutiques, providing them with a digital storefront that maintains the exclusivity and quality associated with luxury retail.

Sellers benefit from Farfetch’s high-spending clientele, advanced logistics, and global shipping infrastructure. The platform handles much of the back-end operations, allowing brands to focus on their core identity.

Fulfillment for luxury fashion requires white-glove service, premium packaging, and detailed handling—all areas where specialized logistics providers can thrive.

20. Wayfair EU

Wayfair EU is the European arm of the US-based online furniture and home goods giant. It receives around 8 million monthly visitors from markets like Germany, the UK, and the Netherlands. The platform specializes in affordable to mid-range furniture, décor, and lifestyle accessories.

Wayfair’s appeal lies in its vast catalog, user-friendly interface, and visualization tools that help customers see how products might look in their own homes. The company also offers financing, bulk orders, and installation services in select regions.

Sellers enjoy access to a wide European customer base, backed by a platform that provides marketing tools, sales analytics, and logistical support. Wayfair’s supplier portal makes it easy to manage inventory and pricing.

Logistics providers play a key role in furniture delivery—handling bulky, delicate items that require careful transport and sometimes assembly. Regional warehousing and last-mile support are crucial to serving Wayfair’s large and diverse audience.

21. eMAG

eMAG is the largest online marketplace in Romania and a rapidly expanding player in Eastern Europe. With around 45 million monthly visitors, it has a strong presence in Bulgaria and Hungary as well. The platform is known for its broad selection of products ranging from electronics and appliances to fashion and home goods.

eMAG has built its success on a combination of competitive pricing, customer service, and regional logistics infrastructure. Its proprietary delivery network, Sameday, enhances speed and reliability across markets.

For sellers, eMAG offers a regionalized dashboard, multi-language support, and cross-border selling tools that simplify expansion into neighboring markets. Its user-friendly interface and mobile-first strategy attract a growing audience of digital shoppers.

eMAG continues to invest in technology and logistics, making it one of the top contenders in Central and Eastern European e-commerce.

22. Wildberries

Wildberries is one of the largest marketplaces in Russia and surrounding regions, including Belarus, Kazakhstan, and Armenia. Before geopolitical shifts impacted its international expansion, the platform reached over 200 million monthly visitors.

Specializing in fashion, beauty, electronics, and household goods, Wildberries is known for deep discounts, massive product variety, and a powerful logistics infrastructure. Its proprietary courier system and wide delivery network allow it to reach even the most remote areas.

Sellers on Wildberries can access millions of customers and use its internal systems to manage inventory, pricing, and returns. Despite limited presence in the EU, Wildberries remains a dominant force in the post-Soviet market space.

23. OLX

OLX operates as a classifieds platform across multiple Eastern European countries, including Poland, Romania, and Ukraine. With a combined monthly traffic of over 50 million, OLX allows users to buy and sell second-hand goods in categories such as furniture, electronics, vehicles, and services.

It’s a peer-to-peer platform, making it fundamentally different from structured marketplaces. While OLX attracts individual sellers, professional merchants also use it to generate leads or offload inventory locally.

The platform is simple to use and highly localized, with each country having its own domain and currency options. Some of the major local OLX domains include:

- Poland: olx.pl

- Romania: olx.ro

- Ukraine: olx.ua

- Bulgaria: olx.bg

- Portugal: olx.pt

- Kazakhstan: olx.kz

- Uzbekistan: olx.uz

- Bosnia & Herzegovina: olx.ba

Its reach and community orientation make OLX an essential part of the resale and informal retail ecosystem in these countries.

24. Heureka

Heureka is a Czech-Slovak online marketplace and price comparison site. With around 10 million monthly visitors, it’s a crucial shopping destination for consumers in Central Europe. Initially a price aggregator, Heureka now allows merchants to list directly and sell through its platform.

It’s particularly effective in electronics, appliances, toys, and health products. Shoppers appreciate Heureka’s transparent reviews, price alerts, and side-by-side comparisons, which influence purchasing decisions.

Sellers can benefit from visibility to high-intent buyers and easy integration with local e-commerce platforms. Heureka has also introduced verified shop programs to improve trust and transparency.

25. eObuwie

eObuwie is a Polish fashion e-commerce platform specializing in footwear. With about 8 million monthly visitors, it’s a key player in Central and Eastern Europe, operating alongside its fashion-forward brand, Modivo.

The platform offers a large range of branded shoes, sneakers, and accessories for men, women, and children. Known for fast delivery and high product availability, eObuwie also integrates with brick-and-mortar stores to offer hybrid online-offline experiences.

eObuwie’s strength lies in its mobile app and customer personalization tools. The brand is expanding into more European markets and improving delivery logistics to support growth.

26. Notino

Notino is a Czech-based online retailer specializing in beauty and personal care products. With around 7 million monthly visitors, it operates in more than 20 European markets, offering cosmetics, perfumes, skincare, and haircare products from well-known global brands.

The platform is recognized for its extensive catalog, fast shipping, and competitive pricing. Notino focuses heavily on customer satisfaction and provides detailed product information, user reviews, and exclusive deals. Its sleek interface and localized websites make it easy for consumers across Europe to shop in their native languages.

Notino has built strong brand loyalty by combining aggressive digital marketing with excellent service and efficient logistics. It is especially popular in Central and Eastern Europe, including the Czech Republic, Slovakia, Poland, and Romania. Some of Notino’s localized domains include:

- Czech Republic: notino.cz

- Slovakia: notino.sk

- Poland: notino.pl

- Romania: notino.ro

- Hungary: notino.hu

- Estonia: notino.ee

- Latvia: notino.lv

- Lithuania: notino.lt

These country-specific sites support local languages and currencies, enhancing user experience and regional reach.

27. 220.lv

220.lv is one of the most visited online marketplaces in Latvia and part of the Pigu Group, which also operates in Lithuania and Estonia. With around 8 million monthly visitors across its platforms, 220.lv offers a wide variety of products including electronics, fashion, home goods, and toys.

The platform is known for its regional focus, competitive prices, and loyalty programs. It serves both individual customers and small businesses, offering features like installment payments and in-store pickup from physical outlets in Riga and other cities.

220.lv’s localized strategy, combined with strong customer support and seasonal campaigns, has made it a leading e-commerce player in the Baltics.

28. Pigu.lt

Pigu.lt is Lithuania’s leading online retailer and also part of the Pigu Group, which includes 220.lv and kaup24.ee. It draws several million monthly visitors and offers a product range similar to 220.lv, including electronics, household items, clothing, and leisure goods.

The platform emphasizes affordability and convenience, with a mix of own-brand and third-party products. Its loyalty program and frequent discount events attract price-sensitive shoppers, and its integration with physical pick-up points helps reduce shipping time and cost.

Pigu.lt is especially appealing to regional brands and cross-border sellers looking to establish a presence in the Baltic e-commerce space.

29. Rozetka

Rozetka is Ukraine’s largest and most influential online marketplace, boasting over 15 million monthly visitors. Originally launched as an electronics retailer, Rozetka has evolved into a full-fledged marketplace offering everything from appliances and books to clothing and food.

Its dominance comes from a blend of strong customer trust, diverse product offerings, and a commitment to fast delivery—even in difficult market conditions. The platform features a user-friendly interface, detailed filters, and a responsive mobile app.

Rozetka continues to play a central role in Ukraine’s digital economy, both during peacetime and times of crisis, by maintaining operations and supporting small merchants.

30. Okazii.ro

Okazii.ro is a Romanian online marketplace that caters to both consumer-to-consumer and business-to-consumer segments. With around 3 million monthly visitors, it is one of the oldest e-commerce platforms in Romania.

The marketplace covers a wide range of categories including electronics, fashion, collectibles, books, and more. Okazii.ro provides listing flexibility, low fees, and options for both auctions and fixed-price sales, similar to eBay’s model.

It remains relevant due to its strong SEO, simple interface, and niche communities, particularly for second-hand and specialty products. While smaller than eMAG, it maintains a loyal base of users looking for deals and hard-to-find items.

31. Joom

Joom is a mobile-first global marketplace with a growing presence in Eastern Europe. Originally based in Latvia and now headquartered in China, it serves budget-conscious consumers across Russia, Belarus, and parts of Central Europe. With around 25 million monthly users globally, its European traffic remains significant.

Joom offers a broad assortment of low-cost goods including gadgets, accessories, clothing, and home items. It stands out for its gamified shopping experience, daily deals, and focus on affordability.

While known for long delivery times from Asia, Joom has been expanding its European logistics capabilities to shorten shipping durations. Its sleek app and engaging UI make it a favorite among younger shoppers looking for cheap, trendy products.

🚀 Get Started with Waredock AI Today

Ready to take your eCommerce business to the next level? Waredock AI is your smart logistics partner—built to streamline your operations, reduce costs, and boost customer satisfaction. Whether you’re a growing DTC brand or a scaling marketplace, Waredock AI helps you automate warehouse decisions, optimize shipping, and gain full visibility across your supply chain.

👉 Join forward-thinking eCommerce businesses already using Waredock AI to power their growth.

Sign up now and experience the future of eCommerce logistics:

🔗 Get Started with Waredock AI