Global e-Commerce sales have grown at a CAGR of 20% over the last decade, reaching ~$3.5 trillion worldwide in 2019 and expected to grow to ~$7.5 trillion by 2026. The share of online retail sales has gone from ~2% of total to ~13%, and is further expected to reach ~22% by 2026

North America has seen a sharp rise in recent years in warehouse leasing from logistics players across the region. The increasing service levels, such as e-commerce and same-day delivery, are influencing retailers to further outsource their services. Many small businesses and local companies in the U.S. rely on external warehousing to contain their costs.

Over the past 3 years, warehouse and storage industry has grown at an annual rate of 11.5%, according to research. In 2021, industry operating expenses grew 28.9% and the growth will continue in 2022.

Strong Demand in Small Spaces Driven by Increase in Last Mile Logistics

Demand continues to outpace supply with the lack of available space contributing to rents being driven up and vacancy hitting record lows. A

Warehouse Automation Market: Post Covid-19 Opportunities Worth $30B by 2026

The push to automate the warehouses was in full force before the Covid-19 but global pandemic forced the companies to change their strategy w.r.t warehouse automation from “good to have” category to “must to have” if they have to sustain in this industry.

Year 2020 and COVID-19 pandemic along with lots of uncertainty has put a bigger spotlight on the use of automation in warehouses worldwide. Whether they’re adapting to new social distancing rules, under pressure to distribute a higher volume of essential goods, struggling to meet same day delivery or trying to add more remote work capabilities. As per LogisticsIQ’s latest post-pandemic market research study, Warehouse Automation Market will reach the milestone of $30B by 2026, at a CAGR of ~14% between 2020 and 2026.

E-Commerce Market Overview

The fast-growing e-commerce market in the region is Canada while the US market is the largest market and it is growing steadily. The e-commerce user penetration is relatively low in Mexico and the Mexican e-commerce market is expected to witness a healthy growth rate in the next 5 years.

The majority of e-commerce companies award contracts to logistics service providers to provide warehousing and distribution service. The high-velocity e-commerce business models necessitate the companies to have technological solutions that increase the speed of the fulfillment processes.

Contract Logistics Market

The major contract logistics players in the North American market are DHL, XPO Logistics, UPS, FedEx, DB Schenker, Ryder System. However, the contract logistics market in North America is fragmented with large number of players operating in the market and providing services at various levels. The companies are following the trends of consolidation and expansion to gain foothold in the market. For instance, In 2018, DB Schenker opened three new contract logistics facilities in US to accommodate both existing and new customers and moved one existing location to a much larger facility. The company expects to open another six or seven contract logistics facilities by 2020.

On-demand and Cloud Based Warehousing

With the emergence of e-commerce, start-ups related to on-demand and cloud based warehousing are gaining popularity. Companies like Waredock, Flowspace and Flexe offer flexibility to the companies in terms of using the warehousing space according to the seasonal demand instead of long-term contracts for a fixed space. This presents tough competition to the existing traditional contract logistics service providers.

Warehousing and Storage Market Size

Businesswire expects that North American warehousing and storage market reaches $86.41 Billion in 2024. In 2021, the estimated Warehousing & Storage industry revenue was US$34.4 billion, according to Statista.

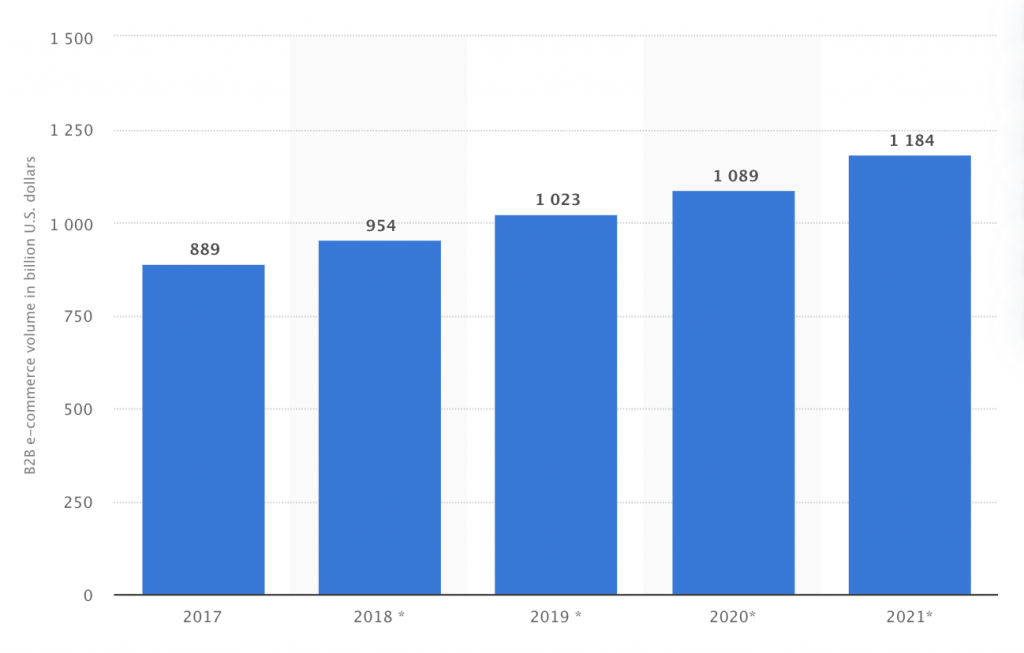

Business-to-Business Ecommerce

B2B ecommerce refers to the marketing, selling, and distribution of products from one business to another online. This includes software as a service (SaaS) companies, wholesalers, and so on. It also includes the buying and selling of companies.

In 2021, business-to-business online sales are projected to reach 1.2 trillion U.S. dollars, up from 889 billion U.S. dollars in 2017.

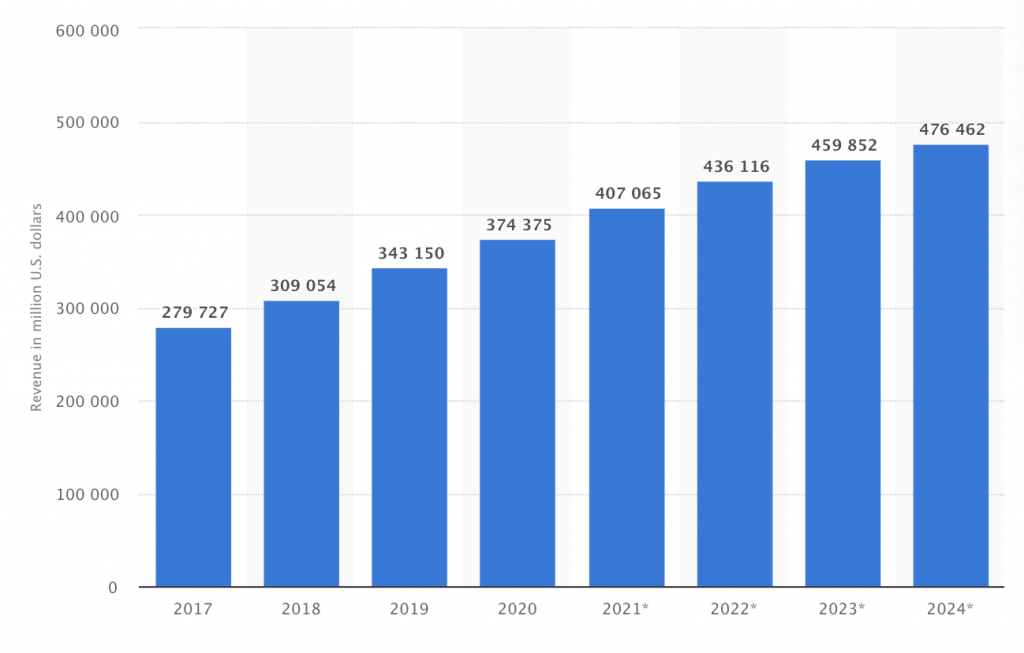

Business-to-Consumer Ecommerce

The U.S. B2C eCommerce market accounted for US$360 billion in 2019. Amazon.com heads the list of the online stores by net sales in the U.S. in 2019. Other large and prominent players on the U.S. market are e.g. walmart.com, apple.com, homedepot.com and bestbuy.com. The top 5 online stores in the U.S. accounted for 40% of the net sales of the top 500 online stores in 2019.

Waredock in North America

Waredock is a cloud logistics provider and we are working with North American 3PL companies, property owners, businesses small and large in a range of industries. We help merchants sell to Europe via our network. Our network includes various warehouse types, with the certifications and designations to store almost any specialized product. And, we’ll provide picking, kitting, shipment consolidation, and more